Personal Finance Habits That Are Helping Americans Avoid Debt in 2025

Smarter money habits are reshaping how U.S. households stay debt-free

In 2025, avoiding debt has become a deliberate strategy for millions of Americans. Rather than relying on credit to maintain lifestyles, households are adopting disciplined financial habits that emphasize planning, transparency, and long-term stability. This shift is not about cutting everything back—it’s about building systems that prevent debt before it starts.

Financial experts say these habits are practical, repeatable, and accessible across income levels, making them a cornerstone of modern personal finance.

Why avoiding debt matters more than ever

Higher interest rates increase the cost of borrowing

Borrowing has become more expensive. With interest rates elevated, carrying balances—especially on credit cards—can quickly snowball. Even modest purchases financed over time can cost significantly more.

As a result, Americans are prioritizing habits that reduce reliance on borrowed money altogether.

Debt limits financial flexibility

Monthly debt payments reduce cash flow and increase stress. Households with fewer obligations have more room to save, invest, and respond to emergencies—advantages that are increasingly valuable in uncertain economic conditions.

Habit 1: Paying themselves first

Savings as a non-negotiable expense

One of the most effective habits is treating savings like a fixed bill. Before discretionary spending begins, a portion of income is automatically directed to savings.

This approach reduces the likelihood of overspending and lowers the need to use credit for unexpected costs.

Automation makes consistency easier

Automatic transfers remove emotion and decision fatigue. When saving happens in the background, households build reserves without constant effort—creating a buffer that prevents debt.

Habit 2: Living below—not at—their means

Redefining lifestyle expectations

Many Americans are choosing to live slightly below what they can afford. This margin creates breathing room and reduces financial pressure.

Rather than upgrading every aspect of life, households are prioritizing value, durability, and long-term benefits.

Delaying gratification strategically

Delaying purchases allows time for comparison and budgeting. This habit alone has helped many families avoid impulse purchases that often end up on credit cards.

Habit 3: Using credit intentionally, not emotionally

Credit cards as tools, not income

Americans who avoid debt use credit cards for convenience and rewards—not to fund lifestyles. Balances are paid in full each month, preventing interest from accumulating.

This disciplined use preserves credit scores while eliminating long-term costs.

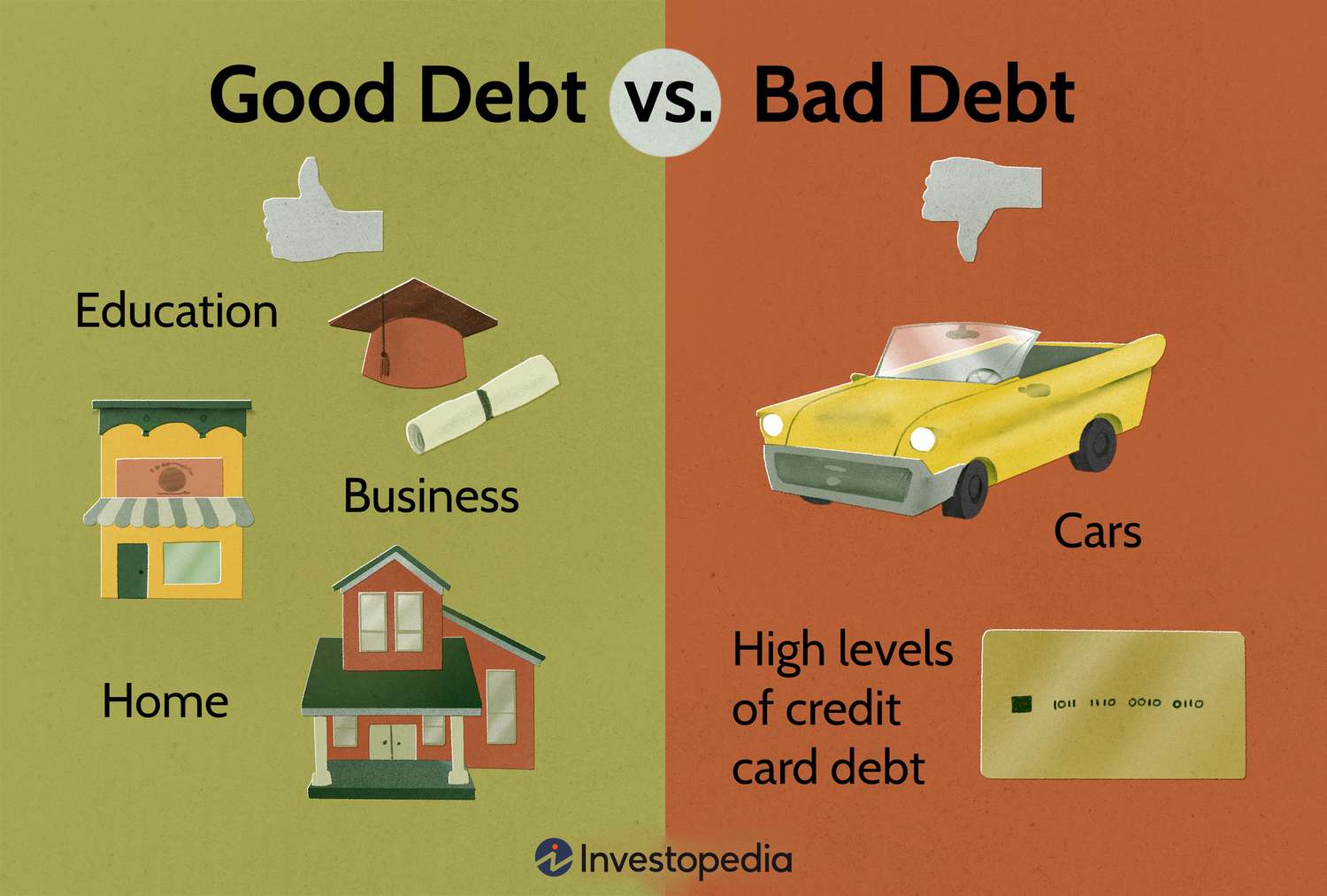

Clear rules for borrowing

Households set personal rules around borrowing, such as never financing depreciating items or avoiding high-interest products altogether. These guardrails prevent reactive decisions.

Habit 4: Maintaining strong emergency funds

Emergency savings reduce crisis borrowing

Emergency funds are one of the strongest defenses against debt. When unexpected expenses arise, households with reserves avoid turning to loans or credit cards.

In 2025, many families aim for three to six months of essential expenses in accessible savings.

Separating emergency funds from daily accounts

Keeping emergency savings in dedicated accounts reduces temptation and ensures funds are available when truly needed.

Habit 5: Tracking expenses regularly

Awareness prevents overspending

Tracking expenses reveals patterns that often go unnoticed. Small, recurring costs can add up quickly and push households toward debt.

Regular reviews help identify adjustments before problems arise.

Technology supports smarter decisions

Budgeting apps and banking tools provide real-time insights. Alerts and summaries help households stay within limits and adapt quickly to changes.

Habit 6: Prioritizing debt repayment strategically

Targeting high-interest balances first

For households with existing debt, prioritizing high-interest balances reduces long-term costs. Paying down these balances frees up cash flow faster.

Experts recommend clear plans rather than minimum-payment approaches.

Avoiding new debt during repayment

Successful repayment strategies often include a temporary pause on new borrowing. This focus accelerates progress and builds momentum.

Habit 7: Setting clear financial goals

Goals create direction and motivation

Specific goals—such as becoming debt-free, saving for a home, or building retirement security—guide daily decisions. Clear objectives reduce impulsive spending.

When goals are visible, financial choices become easier and more consistent.

Breaking goals into achievable steps

Large goals feel manageable when broken into milestones. This approach encourages steady progress without burnout.

Habit 8: Choosing value over convenience

Cost-conscious decision-making

Inflation has sharpened focus on value. Americans are comparing prices, planning purchases, and reducing convenience costs that often lead to debt.

This habit doesn’t eliminate enjoyment—it optimizes spending.

Long-term thinking replaces short-term fixes

Households are increasingly evaluating how purchases affect future budgets, not just immediate satisfaction.

Habit 9: Building financial literacy

Education improves outcomes

Access to financial education has expanded. Americans are learning about budgeting, interest, and long-term planning through digital platforms and expert content.

This knowledge empowers better decisions and reduces costly mistakes.

Confidence replaces uncertainty

Financial understanding builds confidence. Confident households are less likely to rely on debt during uncertainty.

What experts say about debt-free living in 2025

Experts agree that avoiding debt is less about income level and more about habits. Systems, automation, and intentional choices consistently outperform reactive approaches.

These habits are not restrictive—they are protective.

Conclusion: Small habits, powerful results

In 2025, Americans are proving that avoiding debt is achievable with the right habits. By saving first, spending intentionally, tracking expenses, and planning ahead, households are creating stability and freedom.

These habits don’t just reduce debt—they improve quality of life and financial confidence for the long term.