Auto insurance costs are rising fast. Learn proven ways Americans are cutting their car insurance bills without losing coverage.

Auto insurance is mandatory for most drivers in the United States, yet millions of Americans are paying far more than necessary every single year. Rising premiums, complicated policy language, and hidden fees make it difficult for drivers to know whether they are getting a fair deal or being overcharged. Many people assume that high insurance costs are unavoidable, but that simply isn’t true.

The reality is that insurance companies rely on customer inaction. When drivers don’t review their policies regularly, insurers quietly increase rates over time. The good news is that smart drivers across the country are finding effective ways to cut their auto insurance costs—often without changing coverage or sacrificing protection.

This 2025 guide explains exactly how auto insurance pricing works, what factors affect your premium, and the proven steps you can take to lower your bill quickly and legally.

What Affects Your Auto Insurance Premium?

Insurance companies calculate auto insurance rates using complex algorithms based on risk assessment. Understanding these factors gives you the power to negotiate, compare, and reduce your costs.

The most important factors include:

-

Driving history and claims record

-

Credit-based insurance score (in most states)

-

ZIP code and vehicle type

-

Annual mileage and driving habits

-

Coverage limits and deductibles

Even a small change in one of these areas can lead to noticeable savings over time.

Driving History and Claims Matter More Than You Think

Your driving record is one of the strongest predictors of your insurance rate. Accidents, speeding tickets, and previous claims signal higher risk to insurers.

However, many drivers don’t realize that:

-

Minor incidents drop off your record after time

-

Accident-free periods often qualify for discounts

-

Defensive driving courses can lower premiums

If you’ve been driving safely for several years, you may already qualify for a lower rate—but only if you ask.

Credit-Based Insurance Scores Explained

In many U.S. states, insurers use a credit-based insurance score to help determine premiums. This score is different from your regular credit score but is influenced by similar behaviors.

Ways to improve it include:

-

Paying bills on time

-

Keeping credit utilization low

-

Avoiding frequent hard credit inquiries

Drivers with strong credit habits often pay hundreds of dollars less per year for auto insurance compared to those with poor credit behavior.

Why Your ZIP Code and Vehicle Affect Rates

Where you live plays a major role in insurance pricing. Areas with higher traffic density, theft rates, or accident frequency usually come with higher premiums.

Your vehicle also matters:

-

Sports cars and luxury vehicles cost more to insure

-

Cars with strong safety ratings often qualify for discounts

-

Vehicles with anti-theft systems reduce risk

If you’re shopping for a new car, insurance costs should be part of your decision.

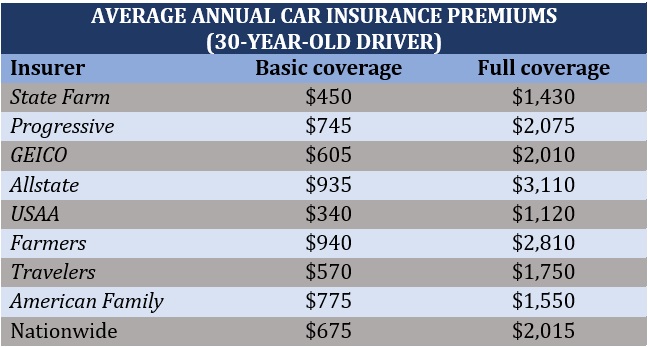

Compare Quotes the Right Way

One of the biggest mistakes drivers make is staying with the same insurer for years out of convenience or loyalty. In reality, insurance companies frequently offer better rates to new customers.

Best Practices for Comparing Quotes

-

Compare quotes every 6–12 months

-

Use identical coverage limits for accurate comparison

-

Check at least three different providers

Many drivers save between $300 and $900 per year simply by shopping around.

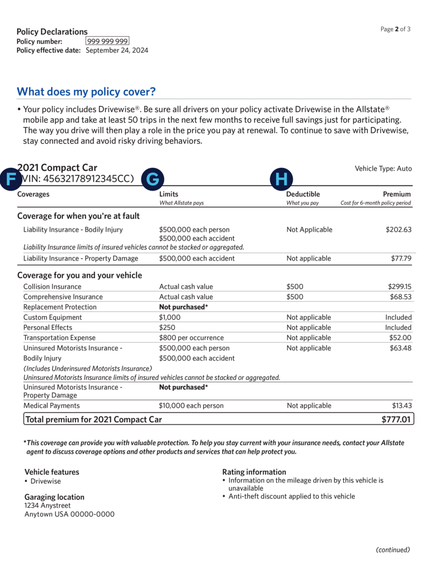

Increase Your Deductible (Smartly)

Your deductible is the amount you pay out of pocket before insurance kicks in. Raising it can significantly lower your monthly premium.

Example:

Increasing a deductible from $500 to $1,000 can reduce premiums by 10–20%.

This strategy works best if you have emergency savings and rarely file claims.

Ask for Discounts You’re Missing

Many insurance discounts are not applied automatically. If you don’t ask, you may never receive them.

Common Auto Insurance Discounts

-

Safe driver discount

-

Low mileage discount

-

Bundling home and auto insurance

-

Anti-theft and safety features

-

Good student discounts for families

A simple phone call or online chat with your insurer can unlock multiple savings opportunities.

Adjust Your Mileage and Vehicle Usage

Insurance rates often assume average driving habits. If your lifestyle has changed, your insurer may still be charging you more than necessary.

You could qualify for savings if:

-

You work from home

-

You drive fewer miles than before

-

You use your vehicle less frequently

Updating your mileage alone can reduce premiums noticeably.

Remove Coverage You No Longer Need

Older vehicles often don’t require full coverage. If your car’s value is low, paying for comprehensive or collision coverage may not make financial sense.

Ask yourself:

-

Would insurance payouts exceed my car’s value?

-

Can I afford to replace the vehicle without coverage?

Dropping unnecessary coverage can save hundreds of dollars per year.

Bundle Policies for Maximum Savings

Bundling auto insurance with home or renters insurance is one of the easiest ways to reduce costs.

Benefits of bundling include:

-

Lower overall premiums

-

Simplified billing

-

Fewer coverage gaps

Most insurers offer bundling discounts between 10–25%.

Why Insurance Companies Don’t Tell You This

Insurance companies profit most from customers who never review their policies. Rates increase quietly while coverage stays the same. Drivers who actively manage their insurance almost always pay less over time.

Being proactive makes you a less profitable customer—and that’s a good thing.

Final Tips to Lower Auto Insurance in 30 Days

Follow this simple action plan:

-

Review your current policy

-

Compare multiple quotes

-

Adjust deductibles wisely

-

Request all available discounts

-

Update mileage and driving habits

Most drivers see savings within one billing cycle.

Final Thoughts

Auto insurance doesn’t have to be expensive. With a proactive approach and a better understanding of how premiums are calculated, you can keep full protection while paying significantly less. Spending just a few hours reviewing your policy today can lead to years of savings.

If you haven’t reviewed your auto insurance recently, now is the best time to start.